20+ Monthly amortization

Calculate loan payment payoff time balloon interest rate even negative amortizations. To calculate a monthly mortgage payment heres a scary-looking formula your lender might use.

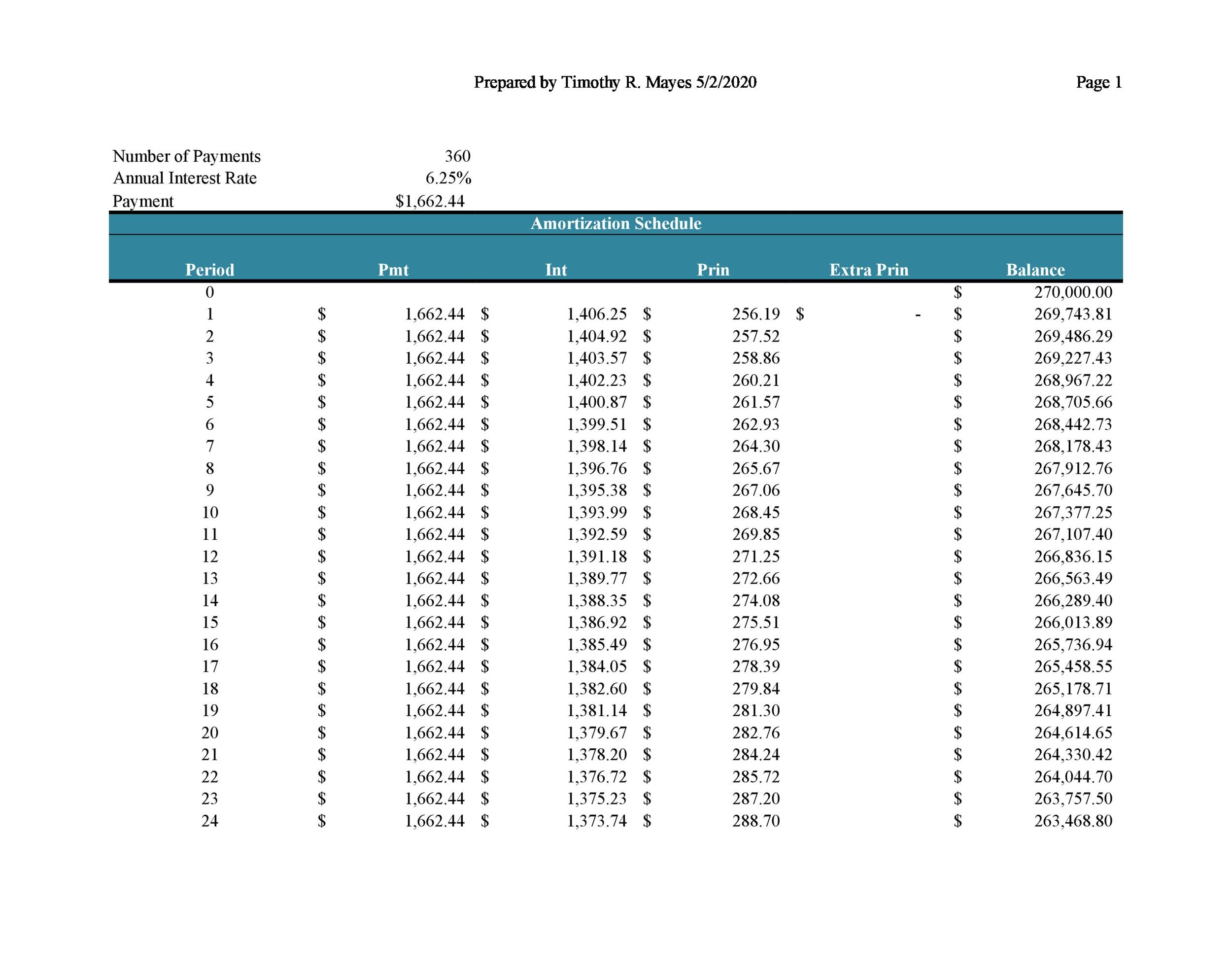

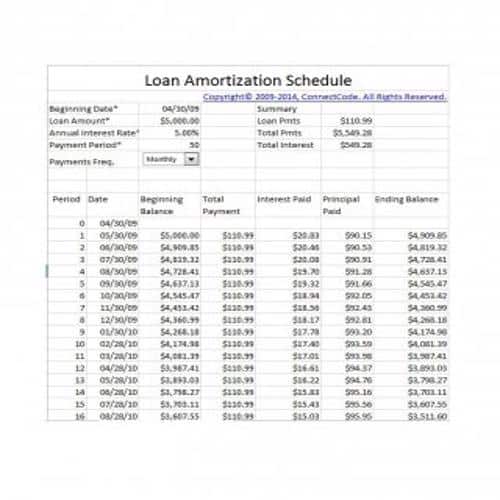

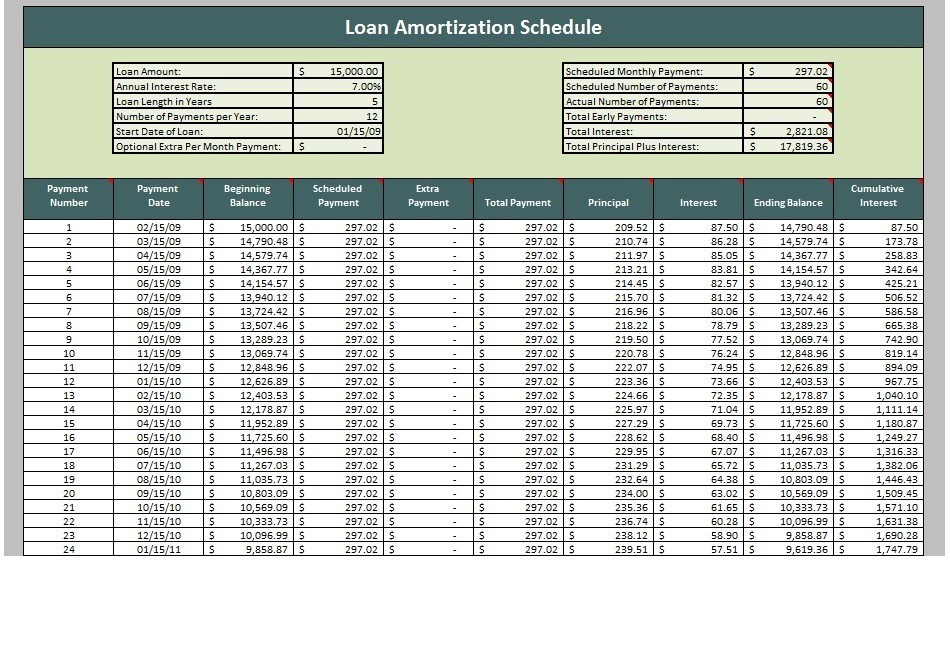

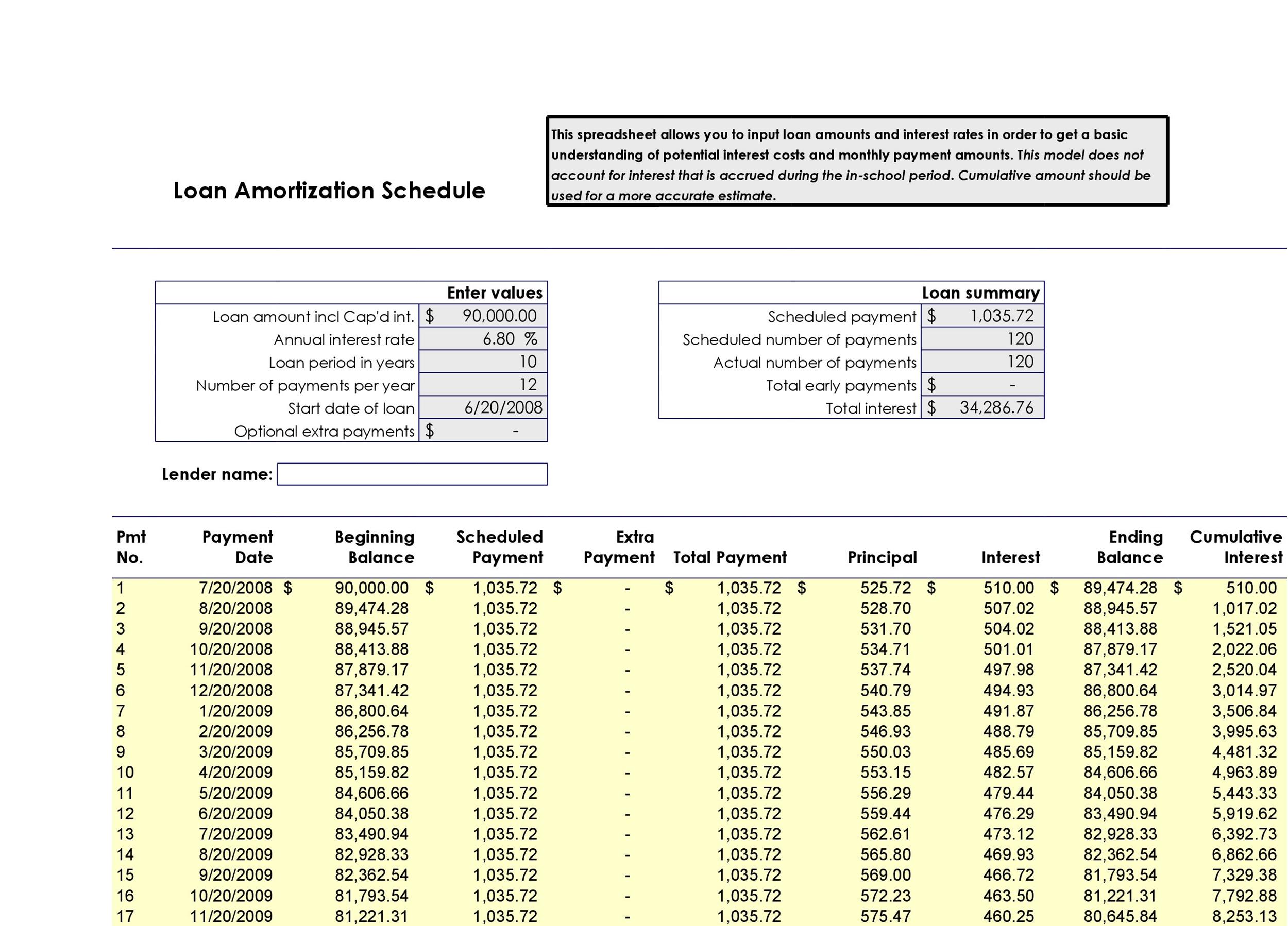

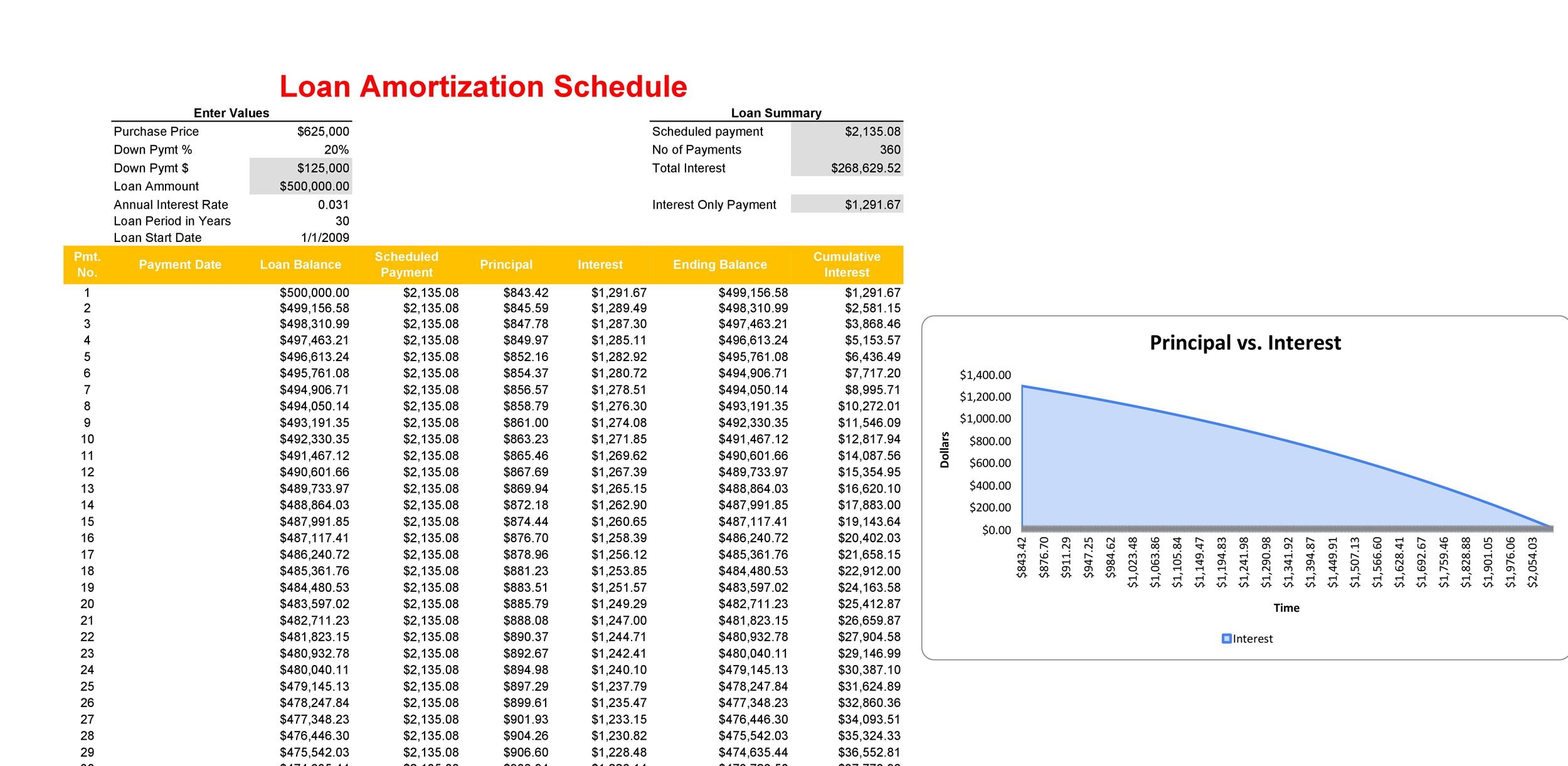

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Second mortgage types Lump sum.

. Added information on utilizing Foreign Account Tax Compliance Act FATCA research to determine and verify the taxpayers ability to pay. If you pay this off over 30 years your payments including interest add up to 343739. Order your essay today and save 20 with the discount code GREEN.

The term usually 30 years but maybe 20 15 or. Adjustable Rate Mortgages usually have total terms of 30 years but the fixed. Account for interest rates and break down payments in an easy to use amortization schedule.

Thats a difference of 52868. When the equity in your house reaches 20 the PMI can be removed so this is another reason to choose the 15 year option - where your equity builds faster. Private mortgage insurance is a percentage of the loan amount.

Youll need the principal amount and the interest rate. Amortization schedules use columns and rows to illustrate payment requirements over the entire life of a loan. However you should typically expect to put down at least 10-15 on owner-occupied properties 20-25 on apartment properties and 25-30 on other types of investment properties.

Calculate the monthly payment of a commercial mortgage. To determine monthly. Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan.

Mortgage Rates See Mortgage Rates. Facebook daily active users DAUs DAUs were 193. Say from 30 years to 20 or even 15.

The principal is the current loan amount. Compute annual average outstanding balance based on the original amortization schedule see below Step 2. Gather the information you need to calculate the loans amortization.

It does nothing for you except put a hole in your pocket. Family monthly active people MAP MAP was 359 billion as of December 31 2021 an increase of 9 year-over-year. Once the equity reaches 20 of the loan the lender does not require PMI.

Monthly MIP Computation Steps Example. This accelerates your payments. Determine monthly payments for 5- to 50-year fixed rate mortgage loans.

A mortgage in itself is not a debt it is the lenders security for a debt. Fair Market Value FMV Non-payment of accounts receivables in dispute. Fourth Quarter and Full Year 2021 Operational and Other Financial Highlights.

In business amortization refers to spreading payments over multiple periods. Second mortgages come in two main forms home equity loans and home equity lines of credit. A longer or shorter payment schedule would change how much interest in total you will owe on the loan.

Each time you make a monthly payment on an amortizing loan. In the latter case it refers to allocating the cost of an intangible asset over a period of time for example over the course of a 20-year patent term 1000 would be recorded each year as an amortization. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

In this case you will calculate monthly amortization. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. Brets mortgageloan amortization schedule calculator.

You can view amortization by month or year. P principal loan amount. M P x ir 1 irn 1 irn - 1.

Simply input your loan amount interest rate loan term and repayment start date then click Calculate. PMI reduces that risk for the lender. M monthly payment.

Family daily active people DAP DAP was 282 billion on average for December 2021 an increase of 8 year-over-year. If the contractual monthly payment stays the same. It also refers to the spreading out.

If MIP financed divide annual MIP from Step 2 by 1 Upfront MIP factor. Keep in mind your monthly mortgage payment may also include property taxes and home insurance - which arent included in this amortization schedule since the payments may fluctuate throughout your loan term. This page was last edited on 20 June 2022 at 0014 UTC.

Ir interest rate per month. Amortization Tables Loan Balance Interest And Principal. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan.

An amortization schedule sets. Almost any data field on this form may be calculated. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

This fee is also rolled into your monthly payment. An amortization schedule is a table detailing each periodic payment on an amortizing loan. View your amortization schedule and plan for your next commercial loan.

To estimate your monthly mortgage payments. 20 15 and 10-year terms. Another way to save money on your mortgage in addition to adding extra to your normal monthly payments is the bi-weekly.

Homeowners are required to have PMI until they pay off 20 of the value of the property. See a complete mortgage amortization schedule and calculate savings from prepaying your loan. When a buyer decides to have a down payment lesser than 20 the loan to value ratio is higher than 80 therefore presenting a higher risk for the lender.

The monthly payments you make are calculated with the assumption that you will be paying your loan off over a fixed period. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. So if at all possible save up your 20 down payment to eliminate this drain on your finances.

One significant factor of amortization is time. Amortization calculator tracks your responsibility for principal and interest payments helping illustrate how long it will take to pay off your loan. This is useful to know when it comes to amortization since your monthly payment is what actually pays down your mortgage.

It also determines out how much of your repayments will go towards the principal and how much will go towards interest. The term is used for two separate processes. Amortization of loans and amortization of assets.

But if you got a 20-year mortgage youd pay 290871 over the life of the loan. Non-cash expenses such as depreciation or amortization of assets Book value vs. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted.

If your down payment is under 20 the bank will require private mortgage insurance. To calculate amortization you also need the term of the loan and the payment amount each period. Our mortgage calculator reveals your monthly mortgage payment showing both principal and interest portions.

View complete amortization tables. Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then. Average Outstanding Balance Annual MIP Rate round to 2nd decimal place based on value in 3rd decimal place.

What Is An Amortization Schedule Use This Chart To Pay Off Your Mortgage Faster

29 Editable Loan Amortization Schedule Templates Besty Templates

13 Amazing Amortization Schedule Templates In Excel Find Word Templates

Have A Need For Financing Call Me Today To Discuss At 503 614 1808 Thebrokerlist Blog

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

13 Amazing Amortization Schedule Templates In Excel Find Word Templates

Debt Amortization Table Download Scientific Diagram

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Instance Of Amortization Schedule By Means Of The Annuity Algorithm Download Scientific Diagram

13 Amazing Amortization Schedule Templates In Excel Find Word Templates

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Maybank Islamic Banking Bba Amortization Schedule Download Scientific Diagram

13 Amazing Amortization Schedule Templates In Excel Find Word Templates